Why choose us

Reduced effort from 4 weeks to 4 days for client credit risk review

for a Commercial Bank.

Automatically identified cost saving opportunities worth $50+ million within a quarter

for a CPG Fortune 500 Company.

Achieved 8X faster app development to transform time to market

for an InfoComm Enterprise.

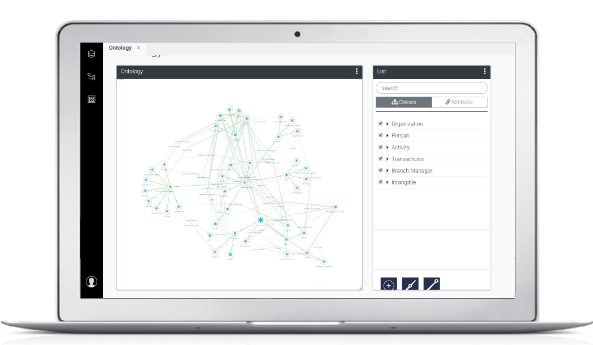

At the heart of it, Ulysses – Latize’s core platform – is an ‘Agile Decision Engine’ that improves an organisation’s decision making process by allowing users to access all relevant data, explore and analyse that data, decide on the best course of action, and then execute and validate those actions – enabling true data democratization.

Ulysses makes this possible by combining artificial intelligence and semantic technology to power its platform. Unbounded by the traditional black box model restraints, Ulysses is more transparent to the user and reactive to regulatory changes. As a result, our secure and scalable end-to-end solutions deliver tangible business outcomes in the shortest time to market.

Our Solutions

Ulysses Capabilities

Technology has greatly increased the speed and complexity of trade flows; and also, the risk of banks’ exposure to trade-based money laundering & terrorism financing (or TBML/TF). In 1H 2021 alone, US imposed over $2 Billion in related fines. In Singapore, a Monetary Authority inspection found undetected errors over years at some FIs and lack of quantitative analysis at others. How can a bank best protect itself?

Our solution, Augmented Trade Risk Management (ATRiM) actively tracks BAFT & MAS Red Flags providing explainable outcomes and modifiable models. Leveraging machine learning and semantic graph, it allows for evolving transactional typologies and user feedback.

ATRiM is preloaded with curated open and proprietary data for enhanced outcomes. ATRiM enables 360-degree, customer-centric risk approach, integrating customer financials, loans and deposits as applicable.

Regulators require banks to periodically grade their customers’ creditworthiness. For example, the MAS Grading (MAS 612) in Singapore. For most banks, this is typically a time-consuming, manual process requiring qualitative and quantitative assessment; and often lacking early warning capability.

Smart Credit Risk Assessment (SCRA) makes this process – data ingestion, analysis, textual analyst report generation – faster and more robust, saving time, money and reducing risk.

SCRA leverages customer and curated external data for quantitative and qualitative analysis to generate Credit Grade and Assessment Report, including the reasons for the recommended grades. It also provides early warning flags for potential credit quality deterioration.

With 360-degree customer-centric risk approach, banks can have a better picture of the risk by integrating credit risk view with AML view.

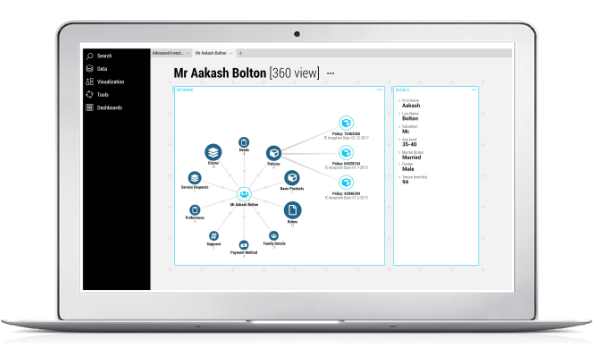

Need to know everything about a specific customer – right now?

With 360-degree customer-centric risk approach, financial institutions can have a better understanding of the customer by integrating customer financials, deposits, loans and trade transactions. This is augmented by curated external data such as news.

Deliver a wholistic Customer-Centric Risk for management to make informed decisions in assessing rates, credit risk, AML flags etc.

Clients Snapshot