Insurance

It’s time to get personal. Deepen customer engagement and boost your sales with an individualized offer for each customer – new and existing.

Want to Learn More?

Increase Revenue and Deepen Customer Engagement

Latize helps insurers increase revenue and deepen customer engagement by providing individualized (segment of 1), needs-based Product Recommendations to new customers and by creating Cross-sell & Upsell opportunities for existing customers. We deliver this in the shortest time to market, even in absence of sufficient data.

How?

Latize Ulysses combines artificial intelligence, a semantics enabled knowledge graph and advanced analysis technology to power its platform. Unlike regular AI platforms, Ulysses does not require a huge volume of data or time to be operationally ready. Unbounded by the traditional black box model restraints, Ulysses is more transparent and ready to meet the requirements of regulatory changes like GDPR.

This means our solutions deliver tangible business outcomes in the shortest time to market, while ensuring forward looking regulatory compliance

Problem

- Life Insurers have little understanding of their customers current situation and life stage due to the low level of ‘touchpoints’

- Customer data is scattered throughout the organization and in policy centric systems

- Life Insurance products are complex with many potential variations and add-ons

- Today’s digital savvy customers expect a highly personalized, proactive digital engagement from Life insurers

As a result, insurers struggle to develop effective, targeted cross-sell and up-sell campaigns that engage the customer and deliver the expected conversion

Cost

- Marketing spends a lot of time researching the right cross-sell or up-sell opportunity for the customer

- Customer is often approached with not-so relevant propositions

- Missed sales opportunities

Solution

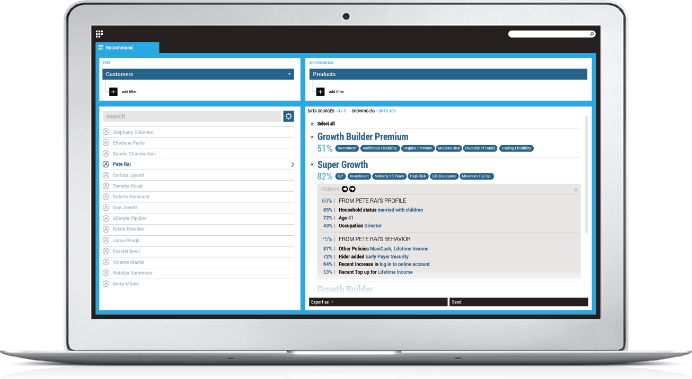

DIY targeted campaign generation

- Enabling Marketers to quickly create their own campaign without relying on IT

- Simple drop down filter interface to configure campaign scope

- Instant 1-to-1 personalised cross-sell and up-sell recommendations for each individual customer, with the right products and features at the right time

- Each recommendation includes the underlying reasons for the recommendation – to include in the customer outreach or share with agents to help them sell

Easy execution

- Recommendations can be automatically fed into any marketing automation tool

Bringing the outside in

- Instead of just relying on internal historical data, other data sources like surveys or social data can be added to enrich customer understanding. For e.g. timely identification of trigger events such as having a baby or taking on the support of an older relative can increase the demand for protection products two to threefold

Benefits

- Increased wallet share by knowing exactly which gaps to fill for the customer

- Improved customer experience make your customers feel like a valued customer, not just a “policy number.”

- Greater efficiency saving time for data analysts, marketers and agents

Problem

- Every month, insurers have a volume of customers maturing, for whom cheques are written to return their investment – with a total value that can easily reach hundreds of millions of dollars per year for one market alone

- Currently, the vast majority of these paid out investment funds flow out of the organization as customers reinvest or repurpose these funds outside of the insurer

- Hardly any proactive action is taken by the insurers to recapture these funds as the time, skills and data required to identify the best reinvestment opportunities for each individual customer are not readily available.

Cost

- Hundreds of millions of dollars of customer funds flowing out of the organization – yearly

- Risk of losing the customer as a whole, not just for this one product

- Missed win-win customer engagement opportunity

Solution

Policy maturity notification

Automatic identification of those policies that are soon maturing, and most importantly, what those customers would be interested to reinvest in

Personalised reinvestment recommendations

A fresh target list at the click of a button with 1-1 personalised reinvestment recommendations for customers – just before their policy matures

Easy execution

The recommendations can be automatically fed into any marketing automation tool

Benefits

- Improved customer engagement proactively address the customer‘s needs in a highly personalised way

- Increase customer retention reaffirming the customer relationship and the insurer’s value

- Retain investable funds stopping the outflow of available funds

Problem

- For many consumers, purchasing life insurance products is a long, painful, and time-consuming process

- New prospects are willing to share only limited information like age, household situation and smoker/non-smoker at the initial prospecting stage (e.g. online or by phone), while expecting highly personalised service

- Agents therefore often rely on experience and gut feel (and in the worst case highest commission) to advise a product – without really understanding the specific needs of the prospect.

Cost

- Mis-selling by agents and lack of sufficient understanding of customer needs

- Prospects dropping out of sales engagement as it’s a cumbersome process and they are not willing to give further information

Solution

Capture Prospect Details in the least intrusive way

- Capturing the minimum required information in the way most convenient for the consumer; whether this is through the insurer’s online chatbot, an agent keying in the information into a digital form, or the customer entering their details directly online.

- Then, an intuitive needs categorization prompted by the system, helps the consumer quickly indicate his main insurance motivation, without having to expose sensitive information.

Get Highly Personalised offers

- Get instant recommendations on the best product(s) for that specific prospect, matching not only the consumer demographics but also his needs, with the features of the available products.

- Each recommendation – together with the underlying reasons for that recommendation – can be reviewed through a user friendly interface

- Pricing information is automatically retrieved from the insurer’s pricing system based on the recommended product and features

Support Frictionless Digital onboarding

- All data collected on the prospect and the offer can be automatically prepopulated in a digital contract form for the agent to send to the customer for signing

Benefits

- Much improved customer experience

- Increased Conversion as prospects are provided with more compelling reasons to buy

- Increased Retention as customers buy the right product

- Lower customer acquisition cost

Why Us?

- Instant uptake – no need to wait for months to get an outcome, get results in as little as three weeks

- Ever increasing conversion – through machine learning, the accuracy and personalisation of the product recommendations will further improve as new customer data gets added and a sales feedback loop is provided

- Forward looking regulatory compliance as each recommendation comes with the underlying reasons for it: a No Black Box approach and GDPR ready

- Easy to use for business user – create your own campaign or customer engagement opportunity – in just a few clicks

- Complete solution, not just a target list – we not only provide recommendations, but help optimize the sales conversion through a predefined testing cycle, clearly defined metrics, and close collaboration with relevant stakeholders like the content team

FAQ

- Q: Can we feed the Ulysses recommendations into our marketing automation tool?

- A: Yes, the recommendations can easily be fed into an marketing automation tool like Salesforce or MS Dynamics through a RESTful API

- Q: How long does it take to implement

- A: Depending on the amount and quality of data available, the initial results can be shown in 3 weeks, including a 360 view of your customer. Further validation and adjustment will take another few weeks, after which the in-market testing & validation will start.

- Q: What is the pricing model

- A: Annual Product license combined with professional services to set up and optimize the solution

- Q: What effort is required from my (insurer) organization

- A: Our implementation approach is very light touch for the client organization. We mainly need to get the required access to the data during set up, and be able to validate our understanding of the data and business requirements.

- Q: What uptake can I expect and by when

- A: Depending on the channel and content, the initial uptake tends to be 50%. We then work with your team during a defined time period (e.g. 1 year) to iteratively test and optimize the results. After this period you can on average expect a 200-300% improvement.

- Q: What happens with the learnings the AI gathers from our data? Is it used for other clients as well?

- A: No, The learning is and remains yours. The Ulysses software is installed at client site with no direct access for Latize to the client’s data, ensuring all the machine learning is retained for the client. This is in contrast to some other centralised cloud based solutions, where the systems learn from all clients and passes the same learnings back to all clients

- Q: What if I do not have a lot of good quality data available?

- A: That is not a problem for Ulysses based Recommendations, thanks to the pre-built knowledge graph. This means that even with little to no historical data you can still get started right away with targeted recommendations, and built up the data and system intelligence over time